Orenda Chooses EML For Its Alluring Zero-code FinTech-as-a-Service Platform In The UK & Europe

EML partners with Orenda’s zero-code, machine learning and serverless technology.

EML partners with Orenda’s zero-code, machine learning and serverless technology.

London, UK – 6th April 2021: Now in its 14th year, the Payments Association Awards (Payments Associationwards), in association with Mastercard, were announced winner of the Best Digital Awards Event

Rush has partnered with EML Payments to deliver its prepaid Mastercard card.

The recipe for success in the e-commerce business is much the same as any other entrepreneurial endeavor except it comes with many opportunities for growth and leverage that physical businesses don’t have.

Online business may be the future of many markets, and for good reason. From scalability of immediately needed resources to cost-effective innovation and optimization, we have identified five key elements of success for e-commerce business in the modern age:

E-commerce businesses can’t put enough of a premium on online cybersecurity and protection against threats. Not only can malicious actors steal data and commit fraud, but they can also completely undermine a customer’s confidence in your business.

To avoid costly fraud and cyber threats, we’ve found five primary areas of focus that e-commerce businesses need to keep in mind as they move forward in the online market:

As more and more organizations have gone digital, there has been a parallel proliferation of cyberattacks that attempt to damage, disrupt or gain unauthorized access to the computer systems of banks and other financial institutions.

So while banks and payment providers are looking for ways to streamline the onboarding process, they must ensure that they build in the necessary safeguards to protect their ecosystems, reputation and accounts owners.

New data from Jumio, the leading provider of AI-powered end-to-end identity verification and eKYC solutions, reveals that new account fraud based on ID verification declined 23.2% worldwide YOY in 2020, compared to 2019 results. At the same time, selfie-based fraud rates were five times higher than ID-based fraud.

3 reasons why you should consider offering credit to consumers

When building a new bank, is it advantageous to be already part of a much bigger established big bank, or might that actually hamper your progress?

How does SMB market look like in the US? Learn not only about this in our latest episode with Anthony Strike from SteadiPay!

Vacuumlabs, the global provider of full-stack fintech solutions, and strategic management consultants Manifesto Growth Architects recently hosted a market-and delivery-focused virtual event, Banking 2021, that brought together key industry players to speak to critical challenges across the banking industry’s new competitive landscape. What are the 5 key takeaways?

Are high street banks effectively taking opportunity of their customer base and provide them sufficient services such as investments, trading or saving?

How to provide 30 million SMBs access to sophisticated financial products, and drive innovation? That’s the question SteadiPay asked, as it finds ways to bring modern Fintech offerings to this underserved market.

If your goal is to service the largest percentage of market users, respect must be given across all accessibility levels. But what is a reliable solution for non-smartphone users? In this post, we review our remote dial option as a reliable PSD2 SCA fallback.

Bottomline was recognized as a winner in the Contact Center of the Year category for technology industries.

We have spoken a lot about strong customer authentication (SCA) over the past year. However, the regulation has technically been in effect since mid-September of 2019. Now well into 2021, it is time for all European countries to fully enforce the updated SCA regulations. Let’s take a look at some of the deadlines.

One of the great innovations of the modern age is the ability of eCommerce to connect businesses, merchants, and consumers all across the world. Not only has this opened up new opportunities for businesses and consumers alike, but also it has expanded the realm of what is possible for small and medium enterprises on the global stage. And here we start with the interesting part of the current topic.

The global economy is expected to begin the process of recovery from the 2020 pandemic throughout 2021 and an integral part of that will be the payments industry as well as virtual IBANs and digital banking.

Analysts see five major trends on the horizon for 2021 in how things will change for the payments industry and digital banking services including enhanced automation to more robust identity verification as well as an authentication technology.

Now, in 2021, and with the Brexit negotiations in their rearview mirror, the EU market is looking to digital banking solutions to help address problems of inequality, sustainability, and supporting a circular economy.

Indeed, the future of the market in Europe is not only digital but digital banking, in particular, will play a huge role in bringing about the social transformations and member-state cohesion needed to build economic resilience and growth for the future.

What are some of the major forces driving the corporate banking digitization process? What are the factors and trends behind some of the most seismic moves in recent years in this otherwise quite conservative industry? What are the main key-topics we should have on our radar in order to stay ahead of our business competitors and be the first to learn what would be the next

“big thing”?

Join in this webinar from Finextra, held in association with Bottomline Technologies, to hear the discussion on the following areas with industry experts:

– Why have the G20 become so focused on cross-border payments today?

– What are the most attractive ways to modernise the cross-border payments operation?

– What impact does trapped liquidity bear on the cost of cross-border payments?

– How does Visa-Swift interoperability enable greater service options and value?

– What role do technology enablers play within this network?

– What are the key benefits of the GPI and Visa B2B Connect solutions?

– Can networks succeed alone or is collaboration the new model?

The EU has not at this point, granted the UK and GDPR equivalency status. We continue to hope that this, or a trade agreement is in place before the 31st. However, we have in place with our EEC clients standard contractual clauses under which we facilitate data transfers.

A new set of Standard Contractual Clauses (SCC) have been drafted, and the consultation period for these closed on the 10th December 2020.

Digital banking is not only the future of banking but also it is allowing for new business segments to emerge and for smaller companies to compete on a more level playing field with major competitors. We’ll explain what they are and how they are making such a massive impact on the financial landscape of today.

The COVID-19 pandemic is changing the way businesses conduct themselves online as well as customer expectations about what they can do. In other words, shopping has moved from the retail space to anywhere a consumer has a smartphone and digital banking is among the greatest business innovations that have enabled this brave new world.

According to new Allstar Business Solutions research, businesses are adapting with varying rates of success to futureproof their businesses in the hopes of surviving the post-pandemic normal

Join K&L Gates For ‘The Future of Financial Services Regulation’ Webinar 17 December 2020 2:00 – 3:00 p.m. ET Please join us for a lively discussion addressing the changing political

The future of global commerce could be a cashless society, many experts predict, and that puts the burden on financial institutions to make sure their customers’ data is secure and protected.

As digital banking rises to replace the more traditional industry, one phenomenon has arisen hand-in-hand with it and that is the use of biometric technologies.

The rise of digital banking has taken the traditional financial sector by surprise and for many good reasons. From pioneering the art of customer service online to using artificial intelligence to handle many of their operational tasks, digital banking is not just a glimpse of the future of finance. It is a peek into the future of the world of business itself.

This is the time that will define the thinkers, movers, and shakers who will shape the rest of this century

Mathias Wikström, CEO of Doconomy, and Johan Pihl, Doconomy’s founder and Head of Innovation & Founder are two people who share the desire to help our planet. They have a powerful vision: to give both consumers and businesses the digital tools that they need to understand and reduce the environmental impact of their consumption. This led to Doconomy launching the Black Card in 2019 – the first credit card to limit spending not on available credit, but on the levels of CO2 emission caused by the owner’s purchases. How does it work – and what are their next steps?

Have you ever wondered what makes a bank a 21st century bank? A small hint; it isn’t the ginormous rigid and extremely expensive mainframes, it isn’t the systems that have to shut down every night for maintenance, and it definitely isn’t the glued-by-hope hollowed out cores.

The list can go on and on. What a good 21st century bank needs is security, scalability, flexibility, availability, and adaptability. So, where do you get it all, nicely packed and with a bow on top at a low cost?

Nektarios Liolios has worked closely with corporates, startups and investors over the last ten years. He set up and led bootcamps, founded competitions for startups, and facilitated cooperations between fintech and financial institutions. How did this all turn out? In all honesty, it was both frustrating and difficult.

Sometimes it’s the smallest pebbles that make the biggest splash. It’s particularly true when it comes to innovation; a simple idea can be the very thing that propels a business into the global arena. But like finding the perfect pebble on a large beach, it sometimes takes another pair of eyes to spot the ideas and features that have the most potential.

For Swedish fintech Doconomy, the collaboration with Vacuumlabs accelerated their journey to making a global impact. We recognized Doconomy’s tremendous potential, and helped it build its most crucial innovation into a world-class product: the 2030 Calculator.

LOUGHBOROUGH, UK – 11 November 2020 The Access Group has today announced it has been appointed by Lloyds Banking Group (LBG) to offer enhanced Direct Debit services to their customer

The future of the FinTech industry might have more to do with a person’s individual biology than numbers and chips in the future, multiple reports indicate. Known as biometric technologies, this group of payments innovations remove the old pin systems and chips of old and replace them or augment them with fingerprint scanners and other biometric methods.

How is the payment industry progressing towards building a digital payments ecosystem?

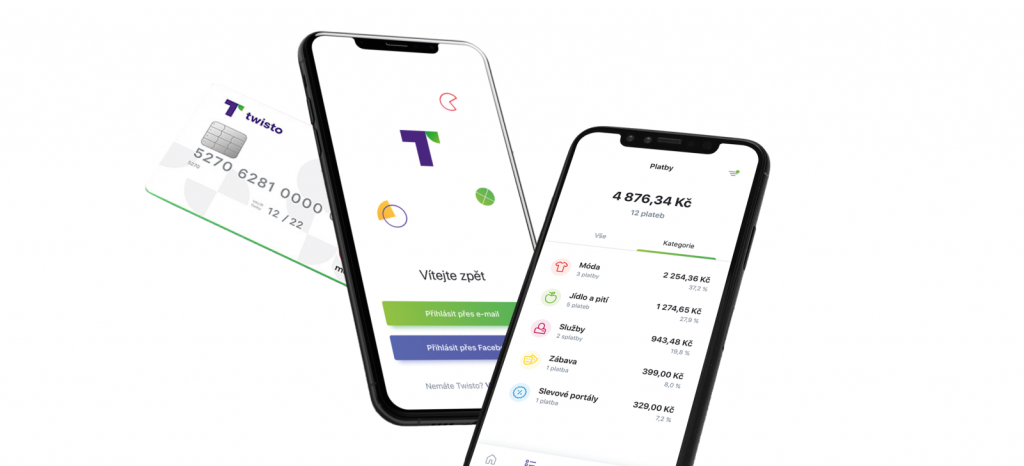

Michal Smida, the founder and CEO of Twisto was a guest on our podcast series Inside the Vacuum and had an exciting conversation with Marcel Klimo around building the next generation of financial services.

Sometimes a fintech company needs to build a new critical feature under time pressure, which can become a very stressful moment for the CTO and Head of Delivery. Thanks to their current development velocity and estimation of the work, they know there is no physical way to build that feature with the capacity they have available. Maybe if they push their developers to the brink of exhaustion, they might be able to do this. This shouldn’t be the way to achieve goals, but rather only to deal with emergencies.

Future-proof your bank with cloud-native tech

How Thought Machine is helping established banks to transform their core platforms

Why deploying your bank to the cloud is very different from using a cloud-native core banking engine

Explore the digital payment market and trending super apps in Southeast Asia with Brano Vargic from Home Credit Vietnam

Financial technology (fintech) has been visibly evolving in front of our eyes ever since banks went online. With an increasingly cashless society, apps and platforms have been created to help us better understand and manage our finances, while new banks have been created that offer us a slicker experience.

How an Australian fintech love brand was born

Payment security taken to a new level

A peek into Indian fintech market and effective solution for accepting payments.

This is the time that will define the thinkers, movers, and shakers who will shape the rest of this century.

Is the European Union going to be the first major global economy to embrace the digital economy advancements, all the benefits it brings forward, and all the digital banking solutions that are coming along the evolution of tech services? What will the EU Single Digital Market bring up on the business horizon?

The transition to an almost purely digital economy is speeding up with every passing year and that is in part due to the leaps and advances in technology that are changing the way we live and conduct business.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.