Three experienced additions join powerful force for change in the rapidly expanding emerging payments industry

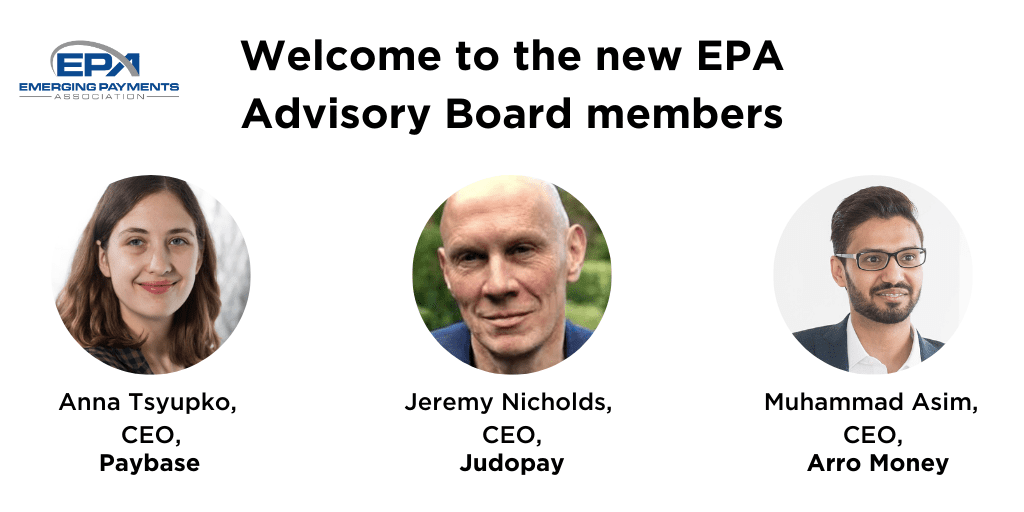

London, United Kingdom – 04th December 2019 – The Emerging Payment Awards (Payments Association), a celebration of collaboration and innovation within new and existing finance companies, has today appointed three of Fintech’s top minds to its Advisory Board. Jeremy Nicholds, CEO at Judopay, Anna Tsyupko, CEO at Paybase, and Muhammad Asim, CEO at Arro Money join the current Payments Association Advisory Board from January 2020, as voted by Payments Association members and with a three-year term.

All three candidates bring a unique perspective to the Board. Jeremy will focus on helping the industry become even more inclusive by involving a wider range of companies, enabling more people in society to benefit from the Payments Association’s products, delivered by people from different backgrounds, orientations, races and genders.

As a young founder of a tech business, Anna will bring a fresh enthusiasm for diversity in Fintech, for enabling the effective adoption of new regulations such as MLD5 in a smooth, customer-friendly manner. She will also help to facilitate both interoperability and partnerships within the blockchain and crypto space.

Being based in Manchester, Muhammad will help broaden Payments Association’s range to include fintech hubs outside London, and to create a bridge with regions outside the UK and EU where interest in emerging payments is exploding.

Speaking on the appointments, Director General of the The Payments Association, Tony Craddock, added: ‘The competition for Advisory Board places gets tougher every year. The community has selected Jeremy, Asim and Anna because they have each proven that they are not only successful business people, but also committed to driving change using our powerful community at the Payments Association’.

For more information about the advisory board, please visit: https://www.emergingpayments.org/ or you can speak to a member of the Payments Association at: info@emergingpayments.org.

Further Information

For further information on the successful new candidates, see below.

Jeremy Nicholds has been at the forefront of payments for over 25 years, leading teams across Visa and Mastercard as well as in a number of NED positions. Currently CEO of the leading mobile payments solution, Judopay, he’s helping companies across multiple sectors to serve their customers with a better way to pay. Previously, Jeremy was an independent advisor in the cards, payments and FinTech space, helping firms to bring new products and propositions to market and to successfully scale them. He was a NED of Vipera Plc – the AIM listed banking solutions provider, and Deputy Chairman for SafeCharge International – a leading edge payment solutions company also listed on the AIM exchange. Jeremy was also Executive Director, Mobile at Visa, where he drove mass market adoption of NFC mobile payments across multiple markets and led the launch of compelling new propositions like Apple Pay, whilst also supporting bank programmes using Visa Cloud Based Payments. Prior to running mobile, Jeremy led Visa’s commercial and business development activities across Europe, working extensively with Europe’s major banks, top retailers and other partners to increase Visa card issuance, boost card acceptance, encourage technology rollouts such as contactless in order to grow volumes of transactions processed. Prior to joining Visa in June 2006, he was SVP, Sales & Marketing at MasterCard responsible for all product marketing, retailer acceptance, and brand communications activity across their European footprint, as well as heading up key account management.

Cambridge and Oxford graduate Anna Tsyupko is the CEO and co-founder of Paybase. She manages the overall direction and strategy of the company, working closely with clients and suppliers whilst overseeing all aspects of the business. With Paybase, Anna is fundamentally changing the old guard of B2B payments. She’s created a challenger brand that creates a space for payments to become a value add to businesses – not simply an afterthought. Under Anna’s stewardship, Paybase have received consistent acclaim for their work disrupting the FinTech industry. As well as being awarded a £700k grant by the government-backed body Innovate UK in 2017, Wired recognised Paybase as one of the companies set to revolutionise finance, with Real Business naming it as one of the UK’s 50 most disruptive companies. It was also included in FinTech Finance’s 2018 ‘FinTech Power 50’. In 2019, Paybase was named one of the top 100 UK companies to escape to (Escape 100) and they were selected from 3000 applicants worldwide to become a member of the global startup community, Startup Grind. Following this, Paybase were also selected as finalists in the Tackling Economic Crime Awards in October 2019. Anna has been recognised by the The Payments Association with the Visa Outstanding Women in Paytech Award, shortlisted as one of PayExpo Europe’s Payments Power 10, awarded CEO of the Year by CEO Magazine as well as being shortlisted for the PayTech Rising Star award and the European Women Payments Network’s Emerging FinTech Leader award.

Muhammad Asim is one of the most dynamic and enthusiastic young entrepreneurs in UK FinTech. He is a CEO, a thought-leader and a keynote speaker. At just 30-years-old, he is the CEO and Founder of Marq Millions, a FinTech organisation that has attracted global unicorn investment. Marq Millions’ core product is Arro Money. Arro provides quick sign-up payment accounts to communities excluded from everyday UK high street banking services. These communities include people that have only recently moved to the UK, people with poor credit histories, and people without a consistent UK address history. Asim conceived the idea for Arro in 2013, aged just 24 and within two and a half years, he had marshalled the founders of Marq Millions, built relationships with the likes of Barclays, Visa, and Mastercard, and been granted an eMoney license by the FCA (Financial Conduct Agency). The Arro product was launched in Jan 2018 and 18 months on, more than 40,000 customers were taking advantage of Arro’s services. In April 2019, Marq Millions were named FinTech Company of the Year at the Prolific North Tech Awards. Prior to founding Marq Millions, Asim led one of Pakistan’s biggest money transfer businesses AA Exchange to huge growth and founded numerous business startups. He was invited by the Prime Minister of Pakistan to contribute to the country’s National Action Plan to counter terrorism.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.