Security And Market Adoption Of Open Banking

There have been lots of discussions recently surrounding open banking. It’s bringing innovation to the financial world by opening up access to bank accounts. Yet, the technology is still in

There have been lots of discussions recently surrounding open banking. It’s bringing innovation to the financial world by opening up access to bank accounts. Yet, the technology is still in

Businesses using open banking report spending 150 hours less on operational tasks each year versus non-users1 Open banking users save on payment processing fees annually, versus businesses using other payment

Open banking unlocks customer data, driving competition and innovation while reshaping the financial landscape for a more inclusive future. Open banking, a revolutionary concept in the financial industry, has reshaped

London, UK, 23 January 2024 – Ozone API, the open banking API platform founded by the team that designed open banking in the UK, today announced that it has raised

As 2023 draws to a close, it’s time for us to take a moment to reflect on the past year and celebrate the accomplishments of our team at Salt Edge.

Open banking — a promised financial utopia where data flows freely, consumers reign supreme, and businesses can reduce their payment processing fees — but what use is this powerful innovation if you can’t get customers to actually adopt it?

As retail open banking continues to grow, mechanisms should be put in place to balance innovative products for consumers while ensuring adequate fraud protection.

The financial industry is experiencing a seismic shift, fueled by the advent of artificial intelligence (AI) and open banking. Far from being isolated phenomena, these two revolutionary forces are converging to redefine the very fabric

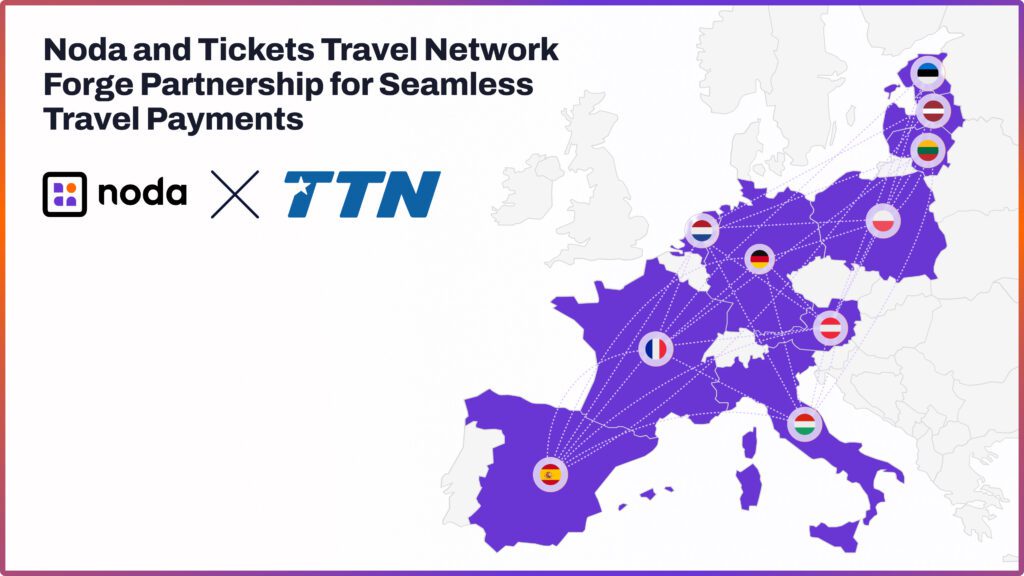

The partnership enables streamlined payment processes across multiple European destinations, with a focus on delivering convenient and efficient payment solutions to travellers. The global open banking provider Noda has joined

Open banking can address customer pain points from bill paying to shop checkouts, but consumers need reassurance to use it with confidence, says Holly Coventry, vice president, international open banking payments at American Express.

Open Banking is not just a trend but a transformative force, driving a sea change in how consumers and businesses interact with financial services. Central to this transformation are Application

NatWest’s open banking payment platform Payit has introduced a new way for businesses to make a payment without needing the recipient’s account details, by sending a secure, single-use payment link.

The neobank industry has grown immensely in recent years matching the rising demand for digital financial services. The convenience, 24-hour customer support, and paths to credit make neobanks appealing and

London, UK, September 5 2023, market-leading open banking solutions provider tell.money supports crypto banking platform, Colossos in expanding open banking capabilities to their customers by powering their PSD2 dedicated interface.

The banking and financial services sector has been thoroughly transformed by technology over the past decade. Previously slow to adapt and adopt new technologies, financial organisations have been so heavily

Open Finance is a financial ecosystem that enables customers to share their financial data securely with trusted third parties in order to access new and innovative financial products and services.

The Joint Regulatory Oversight Committee’s (JROC)’s open banking recommendations have the potential to revolutionise payments, but big investments will be necessary into digital transformation, legacy platform modernisation and cloud migration that is future-proof.

In a report published today on ‘The (Unmet) Potential of Open Banking’, Oxera identifies the key economic obstacles that are holding back the wider adoption of Open Banking and the

In NatWest’s new e-book about Open Banking, three of our specialists offer their views on the UK’s Open Banking journey so far and outline how UK banks could further capitalise

Open finance provider Salt Edge delves into the challenges facing the iGaming sector and how technology could help improve customer experience, increase security and bring in new revenue streams.

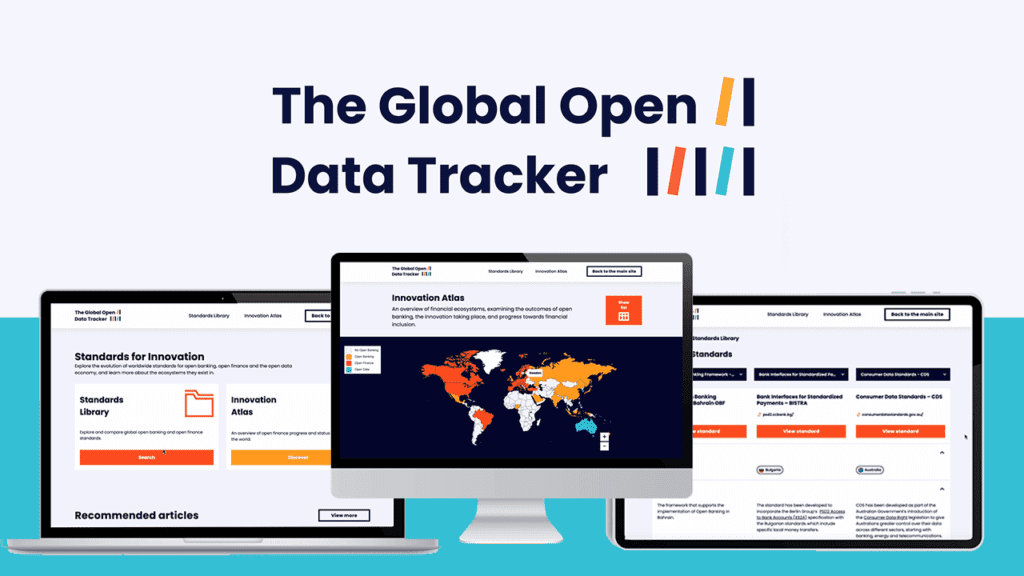

LONDON, 23 May – Ozone API and Smart Data Foundry have today announced a partnership and the launch of two new products – the Standards Library and Innovation Atlas –

LONDON, 26 April – Ozone API, a leading provider of standards-compliant open banking API technology today announced that the Ozone API software solution is available on Temenos Exchange partner ecosystem

Yesterday, the Joint Regulatory Oversight Committee (JROC) delivered its Roadmap for the future of open banking in the UK. Why this is important This is a key development for open

While those hit hardest by the cost-of-living crisis could benefit from using open banking, Stuart Wakefield questions whether the payments sector should be doing more to help.

Noda’s ladies have joined the Women in Open Banking initiative The financial industry has been traditionally dominated by men, but in recent years, there has been a push to increase

Alex Mifsud of Weavr.io examines how technological advancements mean that customers can experience seamless banking across financial institutions.

We’ve previously discussed our conviction that building a fintech solution on our platform is quicker, easier, and better in every way than trying to do it in-house. Cost and time

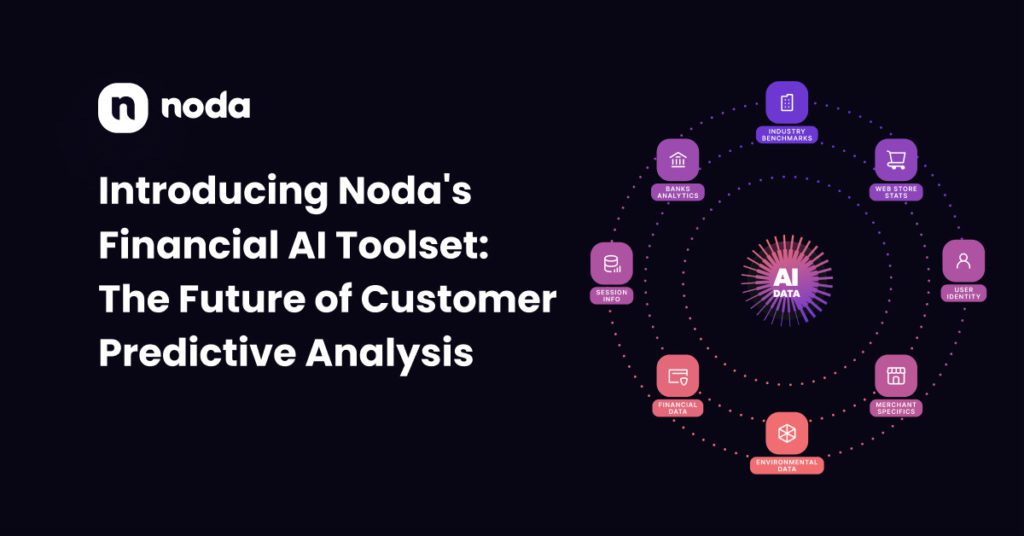

In today’s fast-paced business world, staying ahead of the competition is essential. That’s why Noda has developed a revolutionary new B2B product called the Financial AI Toolset. This powerful toolset

Open banking is leading the way for open finance and open data where robust open APIs and data management will be the cornerstones of success.

Following the announcement of impressive growth in the past year, Weavr has confirmed the acquisition of B2B Open Banking platform, Comma Payments, in a first-of-its kind deal within the world

Shanghai Commercial Bank (“ShaComBank”), an international bank based in Hong Kong offering banking and financial services across the world, including the UK, joined forces with Salt Edge, a pioneer in

Open Banking is 5 years old and has undoubtedly been a success so far. 6.5 million users, 7.5 million payments in total, and 1 billion API calls per month all demonstrate this

In a world where consumer convenience is key, businesses are always on the lookout for new ways to streamline their processes and make the lives of their customers easier –

Noda, billions of instant transactions provider, has partnered with Wargaming to enable Open Banking payments in the gaming industry. Now Wargaming players can choose from a range of online payment

The use of software-as-a-service (SaaS) has surged in the fintech space in recent years. SaaS has become critical to the massive rise of fintech in the wider financial services industry.

ebankIT teams up with Salt Edge to bring full-scale open banking solutions ebankIT, a fintech company that enables digital experiences for banks and credit unions, partnered with Salt Edge, a

Be recognised as an industry leader at the most important payments awards – The PAY360 Awards. Nominations are now open for 2023 awards. You have until 17 February to submit your entry.

In just a few years, open banking laws have gone global. Scores of countries around the world have followed the European Union’s lead by creating their own version of open

The Kingdom of Sweden expands across much of the Scandinavian Peninsula and is one of the largest countries in the European Union by land mass. But what do you know

Despite Open Banking being quite a recent addition to the fintech industry, its market is already full with a diversified number of providers. In such a situation, merchants do not

Open Banking provider Noda has launched direct bank payments in Europe, following a partnership with Open Banking payments platform Token, according to the press release. Noda enables merchants to receive

A new classic: billions of instant and secure payments with no chargebacks 🚀 We are excited to see the payment industry constantly improving in order to be able to provide

Open Banking is predicted to grow to 304 million users by 2026. Merchants, payment service providers (PSPs) and consumers will all benefit from the lower fees, immediacy and increased convenience that Open Banking offers.

Embedded finance is the future of fintech innovation that will benefit all businesses and retailers seeking to remove common barriers to cryptocurrency access, offer various payment methods and enable a better customer experience.

UK-based payments specialists, allpay Limited, have joined forces with Salt Edge, a leader in Open Banking solutions, to allow the business to provide clients, including people with vulnerable financial situations,

UK-based payments specialists, allpay Limited, have joined forces with Salt Edge, a leader in Open Banking solutions, to allow the business to provide clients, including people with vulnerable financial situations,

Representatives from companies such as Starling Bank, American Express, Nationwide, Visa, Mastercard, Bottomline, Clearscore, Vyne, Pennies, Tink, Eversheds Sunderland, Baker Botts and many more came together to discuss the future open banking model.

ECOMMBX, a progressive Electronic Money Institution based in Nicosia, proudly announces that it has concluded a correspondent banking agreement with Citi, the world’s most global bank. This new collaboration delivers

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.