How better regulation can power up UK fintechs

How regulatory reforms and increased capital can drive UK fintech expansion One of the first questions any fintech founder or investor asks is how it will be regulated. Regulation affects

How regulatory reforms and increased capital can drive UK fintech expansion One of the first questions any fintech founder or investor asks is how it will be regulated. Regulation affects

The UK and EU payments sectors continued to draw increasing regulatory scrutiny throughout 2023. Indeed, the need to deliver compliance with new regimes, such as the consumer duty in the UK, required a great deal of firm’s attention and resources throughout the year.

This article was originally published by leading bank orchestration platform Numeral and recently featured in the Payments:Unpacked newsletter from Mike Chambers – subscribe for free at: www.payments-unpacked.com.

The Payments Association is pleased with the declaration released from the recent summit on artificial intelligence (AI) at Bletchley Park, which saw global leaders, tech executives, and academics address the challenges and advancements of the technology.

Join our Financial Services Regulatory Group experts on Tuesday, 3 October 2023 as they discuss recent developments about the Mansion House Reforms presented by the Chancellor in July 2023 and what

Eduard Stringer, director of product management for Europe at FIS, explains why he believes the EU needs to step up and ensure regulation supports the needs of payments businesses and consumers.

With uncertainty over the future of regulating BNPL products, Payments Review examined the current status, the impact of any legislation and what protection three of the UK’s largest providers have in place.

Latest data shows that the regulator’s authorisation of payments and e-money firms is lagging so far behind, it’s rated red against statutory targets.

DIGISEQ recently commissioned Consult Hyperion to do a whitepaper, podcast and webinar on SCA PSD2, in this piece we address the issue of SCA (Strong Customer Authentication) in Passive Wearables.

DIGISEQ recently commissioned Consult Hyperion to do a whitepaper on SCA PSD2, in this piece we address the issue of SCA (Strong Customer Authentication) in Passive Wearables. Rules are in

DIGISEQ recently commissioned Consult Hyperion to do a podcast on SCA PSD2, in this piece we address the issue of SCA (Strong Customer Authentication) in Passive Wearables. Rules are in

DIGISEQ recently commissioned Consult Hyperion to do a webinar on SCA PSD2, in this piece we address the issue of SCA (Strong Customer Authentication) in Passive Wearables. Rules are in

Chris Hemsley, managing director of the Payment Services Regulator (PSR), says the watchdog’s plan will be published by the end of June 2023.

The Payments Association’s Project Regulator has created a five-step checklist for firms that have fallen behind on preparing for the new rules.

Lucinity’s Francisco Mainez outlines how technology can help businesses prepare and comply with the new rules, which are due to come into force in July.

Should payment firms be limited in how they reuse data or are the laws based on GDPR sufficient?

The Payments Association’s Riccardo Tordera and Robert Courtneidge examine what the latest government consultations could mean for the UK payments sector.

A rise in the number of regulations, safeguarding rules, payment methods, corporate costs and the opportunities of ISO 20022 are just some of the biggest considerations for payments firms worldwide

The General Data Protection Regulation (GDPR) needs to be reviewed to allow legitimate data tracking and sharing to tackle financial crime, say industry experts.

Be recognised as an industry leader at the most important payments awards – The PAY360 Awards. Nominations are now open for 2023 awards. You have until 17 February to submit your entry.

The Payments Association’s Project Regulator working group will continue to engage with the FCA in 2023 to ensure members can thrive in the UK payments market.

Many firms still haven’t had the opportunity to drill down on the implications that the Consumer Duty has on their business. A recent webinar outlines the key steps to take.

Payment firms should be prepared for a higher cost of compliance when the Financial Services and Market Bill enters into force in 2023.

The Payments Association asked Kate Fitzgerald, head of policy at the Payment Systems Regulator, about her work and what she will be discussing at the Financial Crime 360 conference.

Rather than building a single global rulebook for payments, regional rulebooks are the better approach in the medium term, according to industry participants.

Today, The Financial Conduct Authority (FCA) has published its finalised rules on the new consumer duty, which aims to “fundamentally improve how firms serve consumers”. The FCA states that the

Check out this recent Financial IT interview featuring Currencycloud’s Co-Founder & VP Strategic Partnerships, Stephen Lemon and ComplyAdvantage’s Founder and CEO Charles Delingpole as they discuss all things Fintech.

Watch the interview here: https://www.youtube.com/watch?v=XG9JlvilL10

The FCA and PSR have published a joint response to the Cash Action Group’s (CAG) announcement that retail banks and building societies will create an independent body to assess the cash needs

Join VIXIO PaymentsCompliance and guest speakers to learn about how to tap into the opportunities in five key growth markets, and how to overcome the challenges.

In line with recommendations made in the Kalifa review, the FCA has committed to introducing a new Regulatory Scalebox to ensure that high growth firms have the appropriate support and oversight. The FCA also committed to providing stronger regulatory oversight for newly authorised firms in its Business Plan. As part of this commitment they are inviting Payments Association members to join them at one of their 2 virtual workshops running on 22nd and 29th September. These workshops will be particularly valuable for members that are either currently experiencing rapid growth and scale, have experienced this in the past, or are newly regulated.

– What is Behavioral Biometric Analysis?

– What is a BionicID™?

– What makes Revelock’s BionicID™ solution unique in fraud prevention?

– How can BionicIDs™ be used to stop Impersonation and Manipulation attacks?

– What is BionicID™ analysis best suited for?

– Does BionicID™ data collection or analysis impact the User Experience (UX)?

– Introduction

– Deep fakes

– SIM swap scams

– SMS OTP fraud

– Session hijacking via RATs

– Originality is key

– Introduction

– Reducing false positives and negatives

– Know Your User

– Automating fraud response

– Conclusion

What are the top priorities, challenges, opportunities and risks for compliance and risk executives in 2022? VIXIO PaymentsCompliance is running its annual Trends and Priorities Survey to gain insight on just that.

One of the most discussed subjects in the industry today is how digital has transformed banking and financial services. And of course this has been even further amplified by the Coronavirus pandemic.

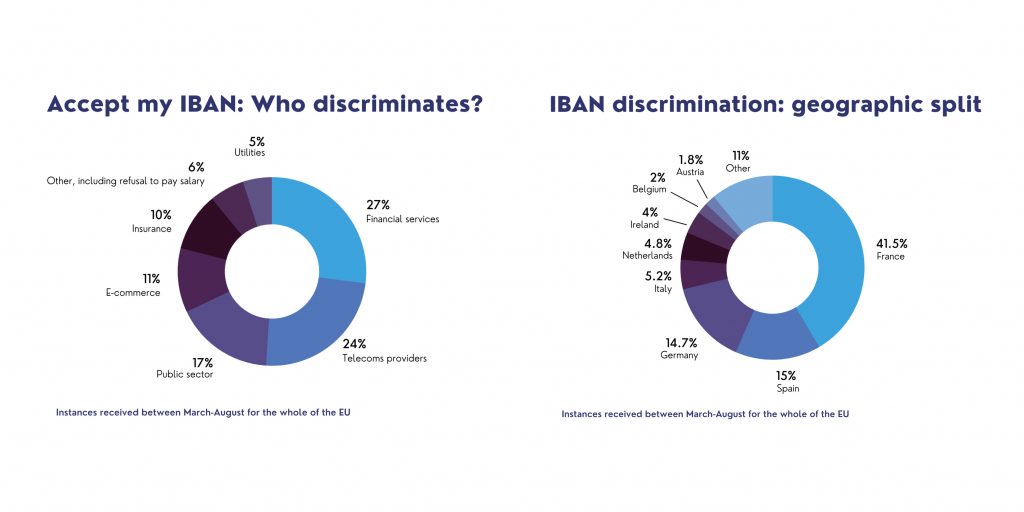

The UK authorized payment institution Monneo joins the ‘Accept my IBAN’ coalition of European companies to tackle corporate rejection of SPayments Association-enabled IBANs for payments and direct debits.

Discover Global Network, an international payment network, certified the Netcetera ACS for Diners Discover Network card transactions. Certified with all major card networks, the access control server improves user experience and promotes secure and frictionless transaction authentication worldwide.

The proposed anti-money laundering (AML) authority (AMLA) will be a gamechanger for the supervision of AML efforts in the European Union, experts in the field have told VIXIO.

Cybertonica are areintensifying their partnership with @W2GlobalData, global experts of regulatory compliance technology to bolster combined regtech and fraud offerings to multiply the value & benefits to all their shared & new clients!

On 22 June 2021, HM Treasury (HMT) confirmed that it will take forward legislation to introduce a gateway for the approval of financial promotions of unauthorised persons. Once the gateway is in place, only firms which have successfully applied to the FCA to approve financial promotions will be permitted to approve the financial promotions of unauthorised persons.

Compliance with regulatory requirements regarding the approval of financial promotions has been a recent supervisory concern for the FCA, especially in circumstances where the products being marketed are complex and targeted at the retail market, and the FCA has issued a number of letters and publications setting out concerns and guidance for authorised firms approving financial promotions

To make it easier for members of the The Payments Association to navigate the evolving landscape of payments regulation, the Payments Association and Eversheds Sutherland are providing you with a resource that will keep you on track. The Payments Regulatory Roadmap is designed to give an overview of the areas of payments regulation that our members should be anticipating in the next two years and to know the next steps and action required. And to help you prioritise what is of critical importance and what is less impactful.

The distribution of this banking trojan is one of its main strengths since the use of text messages impersonating delivery services companies is a really good idea for deceiving the victims and getting them to install the malicious application.

The mandatory geolocation in banking transactions came into force in Mexico as of March 23, 2021

Today is a monumental day for us and we’re delighted to announce that Revelock · A Feedzai Company is getting acquired by Feedzai.

Our CEO Pablo de la Riva Ferrezuelo explains how – by joining forces – the two companies are stepping up the fight against financial crime in this era of cashless commerce..

Monzo Bank has been in financial danger for some time and now, in its latest annual report, has admitted that the UK’s Financial Conduct Authority (FCA) is investigating it for its compliance or otherwise with the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017.

Payments Association publishes response to FCA CP21/13 A New Consumer Duty, raising extra burden concerns for firms The Payments Association’s response supports focus on consumer protection but fears extra

PSD2 is a hot topic for the UK market. How can we tackle it?

We take a look at challenges and solutions for the UK payment ecosystem in complying with PSD2 requirements.

With PSD2 now live in most European countries, being 5 months past the December 31, 2020 deadline, the UK is next, as the deadline for March 2022 is approaching. In order for the cardholder and merchant to properly adopt additional authentication without abandoning the transaction, the main focus is eliminating as much friction as possible. Testing data¹ from merchants such as Amazon, Google and Microsoft has shown that although Strong Customer Authentication has been enabled for most of the UK ecosystem, it is still grappling with several issues. Examples of this are relying on Risk Based Authentication for lower challenge rates, issuer readiness on latest protocols, issuer latency and lastly confusion on what exemptions to properly utilize.

– Introduction

– Poor hygiene & Persistent threats – ‘perfect storm’ of online fraud

– Customers expect Banks to Know Your User

– Fraud Fighting Collective – Fraud Fusion Centers

– Overwhelmed with Alerts, Automation is key

– Clear ‘risk calculation’ – Frictionless First

– No silver bullet – but there are best practices

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.