Year-end 2023 payments quiz

A lot has gone on in the payments sector in the last 12 months, but have you been paying attention? There’s only one way to find out, we’ve devised a quiz to test your mettle below.

A lot has gone on in the payments sector in the last 12 months, but have you been paying attention? There’s only one way to find out, we’ve devised a quiz to test your mettle below.

Plenty has happened in the payments space over the past 12 months. Landmark legislation has been passed and new technologies such as artificial intelligence (AI) have integrated themselves further, irreversibly changing the way transactions will be made. As the year draws to a close, we take a look at other triumphs and challenges faced by the industry in the past 12 months.

While there is efforts by the BRICS countries to reduce their dependency on the US dollar as the global reserve, experts cast doubt whether the process of de-dollarisation could actually be help ease payment friction.

The UK holds a strong position in the rapidly developing fintech and digital payments world, but experts are divided over whether this will lead to a major breakthrough next year.

It’s not easy being green, especially when environmental, social and governance (ESG) obligations are mounting amid an uncertain economic picture. But businesses can no longer ignore the voices of consumers worldwide who are demanding immediate and impactful climate actions – and this is where fintechs have a vital role to play.

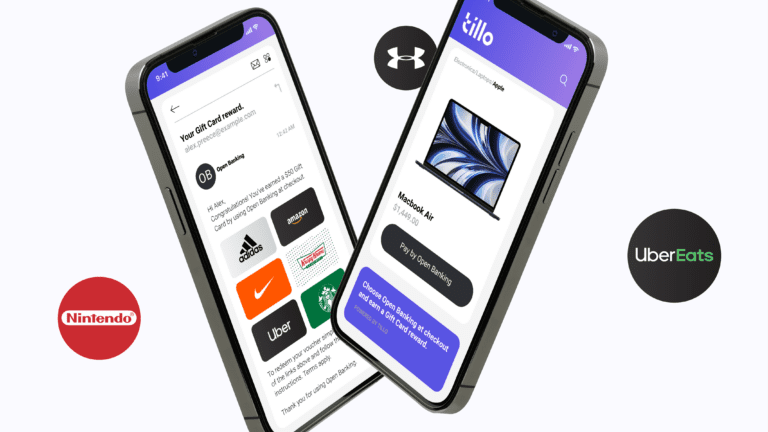

Open banking — a promised financial utopia where data flows freely, consumers reign supreme, and businesses can reduce their payment processing fees — but what use is this powerful innovation if you can’t get customers to actually adopt it?

As part of yesterday’s 2023 Autumn Statement, the Future of Payments Review was published. Commissioned by HM Treasury and led by Joe Garner, the review provides a number of recommendations on the

Today, The Payments Association head of policy and government relations, Riccardo Tordera attended the release of Visa’s report, Payments: Putting customers first at the offices of EY.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.